Bright-line test and family transactions

Summary

1. The bright-line test for disposals of residential land initially had a 2 year bright-line period, then a 5 year bright-line period (the topic of this fact sheet), and now has a 10 year bright-line period or a 5 year bright-line period for new builds.

2. This fact sheet may be relevant to you if:

- you entered into a binding agreement to purchase residential land (that is not your main home) from 29 March 2018 to 26 March 2021 (inclusive);

- and you are disposing of (including selling) the residential land (such as a rental property) within the 5 year bright-line period.

3. This fact sheet covers the situations when you:

- are a parent who assists your child with buying their first home;

- add your new partner to the title of your residential land; and

- inherit a share of residential land under a will, and you sell your share to the other beneficiaries who own shares in the inherited residential land.

4. If you sell residential land to your family member or partner within the bright-line period, you may be taxed under the 5 year bright-line test in s CZ 39.

5. If you gift residential land or the payment you receive is below its market value, you will be taxed on the market value of the residential land instead.

6. If you sell residential land inherited under a will, the sale is exempt from the bright-line test.

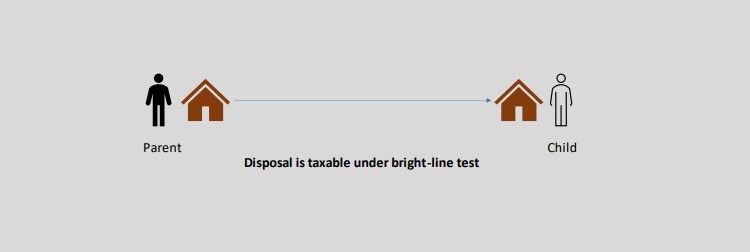

Parent disposes of residential land to their child

You may be a parent who assists your child to buy residential land. You purchase the residential land personally, as a trustee of a trust, or by a company you are a shareholder of. You do not purchase the residential land as a nominee or bare trustee for your child.

Your child may provide funds towards the purchase. You are the borrower from the bank if there is a mortgage in your name registered against the residential land. You rent the residential land out to your child or a third party until your child is able to buy it from you. They may pay or reimburse you for all or some of the ongoing expenses.

You dispose of the residential land to your child for the market value within the bright-line period. The payment you receive from your child is income under the bright-line test. You will still be taxed on the market value of the residential land if you disposed of it for less than market value. You can deduct your cost of the residential land, and this can reduce the amount of income you have to pay tax on.